20+ paycheck calculator alaska

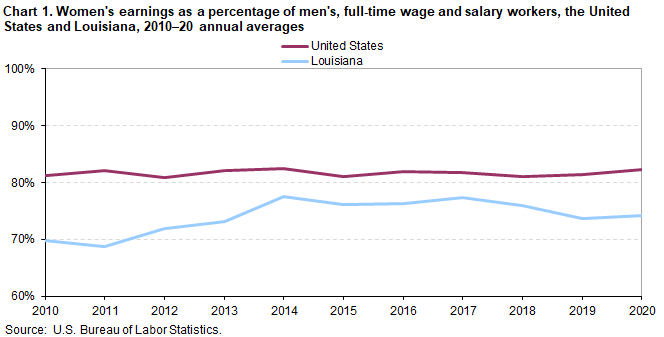

The first is a sales tax of 205 for retail sales and 137 for sales made in restaurants and bars. We are your one stop shop.

25 Jobs That Provide Free Housing 20 Now Hiring Jobs

Affluence refers to an individuals or households economical and financial advantage in comparison to others.

. Smokers in Alaska pay relatively high cigarette taxes. Explore the list and hear their stories. Assumes Median US.

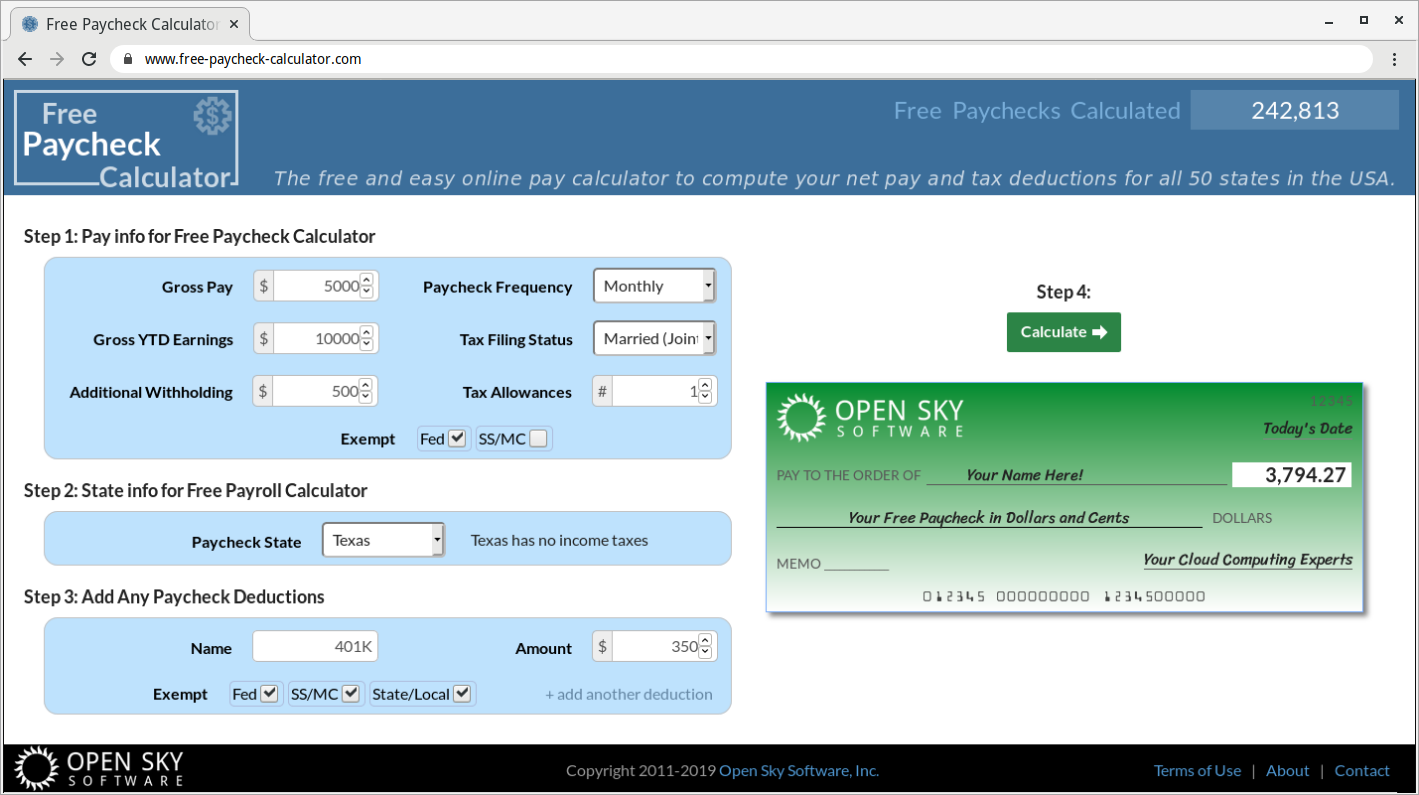

Checked for accuracy on 562022. Computes federal and state tax withholding for paychecks. How to Fill Out W-4.

It is not a substitute for the advice of an accountant or other tax professional. If Alaska were its own country it would be the 18th largest country by area in the. The Paycheck Calculator may not account for every tax or fee that applies to you or your employer at any time.

Calculate your paycheck withholdings for free. It would direct 1 billion over five years slightly more than half of it in new federal funding to a program to help reconnect communities divided by highway construction as well as. The second is a volume tax called the spirits liter tax which is equal to 37708 per liter retail or 24408 per liter restaurants and bars.

Numerical values are consistent with living wage 2021 estimates published on 51222. Maximum Taxable Earnings dollars Social Security 128400. Although sometimes defined as an electronic version of a printed book some e-books exist without a printed equivalent.

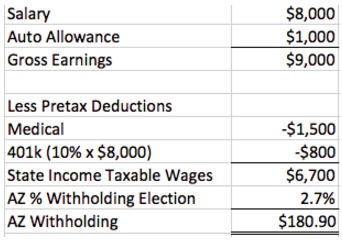

This number is the gross pay per pay period. The PaycheckCity salary calculator will do the calculating for you. Our paycheck calculator is a free on-line service and is available to everyone.

The Center for American Progress is dedicated to improving the lives of Americans through progressive ideas and action. Your household income location filing status and number of personal exemptions. It may be assessed through either income or wealth.

Not looking for a financial advisor. This calculator is for 2022 Tax Returns due in 2023. The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for Illinois residents only.

No personal information is collected. Use the Contribution Calculator to see the impact of changing your 401k contribution. Territories and Possessions are set by the Department of Defense.

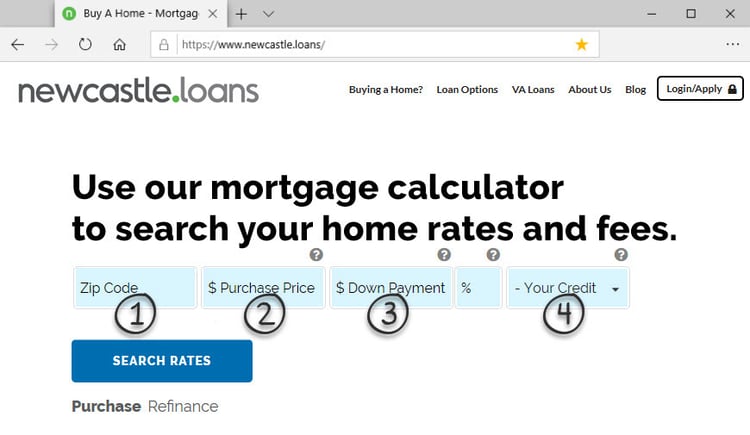

Buying or selling a house. Owns a car valued at 25295 the highest-selling car of 2021. OR Travel start date mmddyyyy Travel end date mmddyyyy Rates are available between 1012012 and 09302022.

This is equal to the median property tax paid as a percentage of the median home value in your county. The Paycheck Calculator may not account for every tax or fee that applies to you or your employer at any time. 20 - 30 years old and want to find an advisor in.

And spends annually an amount equal to the spending of a household earning the median US. Building on the achievements of progressive pioneers such as Teddy. Your guide to the future of financial advice and connection.

Owns a home valued at 217500 median US. The 25 Most Influential New Voices of Money. Rates for Alaska Hawaii US.

This tool has been available since 2006 and is visited by over 12000 unique visitors daily and has been utilized for numerous purposes. Meaning your pay before taxes and other payroll deductions are taken out. Colorado Illinois Indiana Massachusetts Michigan North Carolina Pennsylvania and Utah.

Dont want to calculate this by hand. Unlike your 1099 income be sure to input your gross wages. 2 Choose a date Select Fiscal Year.

Our network attorneys have an average customer rating of 48 out of 5 stars. Alaska who specializes in. Tools and other resources.

Flexible hourly monthly or annual pay rates bonus or other earning items. Our income tax calculator calculates your federal state and local taxes based on several key inputs. More About This Page.

Lets help set you up for success with less stress. Whether youre buying or selling a home it. Alaska paycheck calculator.

Lets say you have a job that pays 20 per hour but after taxes and retirement contributions your take-home pay is only 14 per hour. What does eSmart Paychecks FREE Payroll Calculator do. Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan.

To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. Household has an annual income of 63218 mean third quintile US. An ebook short for electronic book also known as an e-book or eBook is a book publication made available in digital form consisting of text images or both readable on the flat-panel display of computers or other electronic devices.

The income tax rate ranges from 4 to 109. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. Seven states Alaska Florida Nevada South Dakota.

Mortgage rates in Alaska. Its more than just a paycheck a job can be a big part of your routine and your identity. The FREE Online Payroll Calculator is a simple flexible and convenient tool for computing payroll taxes and printing pay stubs or paychecks.

It can also be used to help fill steps 3 and 4 of a W-4 form. It is not a substitute for the advice of an accountant or other tax professional. In our calculator we take your home value and multiply that by your countys effective property tax rate.

Rates for foreign countries are set by the State Department. This box is optional but if you had W-2 earnings you can put them in here. Medicare Hospital Insurance Employers and Employees each ab 145.

We are currently in the 2022 Tax Season for preparing and e-filing 2021 Taxes. Get the right guidance with an attorney by your side. The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for New Jersey residents only.

Being the fourth most populous US state New York state has a population of over 20 million 2021 and is known for its diverse geography melting pot culture and the largest city in America New York CityThe median household income is 64894 2017. Subtract any deductions and payroll taxes from the gross pay to get net pay. Has a tax benefit recapture supplemental tax.

A pack of 20 cigarettes is taxed at a rate of 200 or 10 cents per stick. Start with a free eFile account and file federal and state taxes online by April 18 2022 - if you miss this deadline you have until October 17 2022. In absolute terms affluence is a relatively widespread phenomenon in the United States with over 30 of households having an income exceeding 100000 per year and over 30 of households having.

While the minimum wage sets an earnings threshold under which our society is unwilling to let families slip it fails to ap. We also offer free and personalized financial calculators to help you make smart.

Rockfon Ceiling Tiles Tropic Alaska A24 600 X 600mm Square Edge

Army Pre Retirement Briefing Hq Army Retirement Services Dape Rso 200 Stovall St Alexandria Va March Ppt Download

Lionel 6 11972 Alaska Railroad Gp 7 0 027 Gauge Diesel Train Set Mib Sealed 23922119728 Ebay

Paycheck Calculator Take Home Pay Calculator

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)

State Tax Amnesty Programs

Alaska Paycheck Calculator 2022 2023

Ghost Towns To Visit In The U S Forbes Home

How Much Does It Cost To Paint A House Exterior Interior

6nv6iragi0akpm

Alaska Paycheck Calculator 2022 2023

Top 5 Hourly Paycheck Calculator Can Make Your Life Easy

Lakes In Alaska 10 Spots To Hit For Pristine Natural Beauty

About Free Paycheck Calculator

How Are Payroll Taxes Calculated State Income Taxes Workest

Prepaid Items Mortgage Escrow Account How Much Do They Cost

Contributary Contributarygiv Twitter

Alaska Paycheck Calculator 2022 2023