15+ Refi calculator

30 year FHA refi. Getting The Most From Your Bank.

Home Mortgage Calculator Templates 13 Free Docs Xlsx Pdf Mortgage Amortization Calculator Line Of Credit Mortgage Calculator

Estimate your monthly payments with PMI taxes homeowners insurance HOA fees current loan rates more.

. Finally in the Interest rate box enter the rate you expect to pay. A Fixed-rate mortgage is a home loan with a fixed interest rate for the entire term of the loan. 30 year fixed refi.

Parent PLUS loan rates are 628 and graduate PLUS loans are 528. Streamline Refi Cash-out Refi Rehab Loan. For today Tuesday September 13 2022 the current average 30-year fixed-mortgage rate is 610 rising 8 basis points compared to this time last week.

High yield CD and MMA. VA Streamline Refi 2022 March 25 2022 FHA Streamline Refinance. This net worth calculator helps determine your net worth.

For example a 30-year fixed-rate loan has a term of 30 years. VA IRRRL rates and guidelines. As the Federal Reserve has lifted short-term interest rates in the late 2010s many homeowners who typically opted for the cash-out refi option in the prior decade became more inclined to use a home equity loan or line so they keep their existing low rate on the majority of their home debt.

The Loan term is the period of time during which a loan must be repaid. For today Wednesday September 14 2022 the national average 15-year fixed refinance APR is 5570 up compared to last weeks of 5380. You can change the loan term or any of the other inputs and results will automatically calculate.

Here are some of the advantages of a 15-year mortgage over a 30-year mortgage. The average 51 adjustable-rate mortgage ARM refinance rate is 4470 with an APR of 6200. Simple Refi FHA Reverse.

Learn About A Home Equity Line of Credit While most families consider taking out a second or third mortgage on their home there are other options available that may be more beneficial in. 15 year fixed refi. The federal student loan interest rate for undergraduates is 373 for the 2021-22 year.

The first calculator figures monthly home payments for 30-year loan terms. Crunch the numbers with this mortgage refinance calculator. The first set was published on 782022 and was incorporated into the Bureaus rate spread calculator until 7152022.

Use our mortgage calculator to determine your monthly payment amount. Also offers loan performance graphs biweekly savings comparisons and easy to print amortization schedules. 20 year fixed refi.

Base Loan Amount x 45 for 15 yr12 effective after 012615 00 mo. One of the most common examples is refinancing a 30-year mortgage to a 15-year mortgage which typically comes with a lower interest rate though this will most likely. Cash Out Mortgage Refinancing Calculator.

30 year fixed refi. You can also speed up your loan repayment to a bi-weekly cadence which. So 30-year loans carry higher interest rates than 15-year loans.

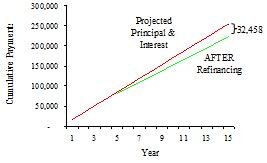

Retirement plan income calculator. Use a mortgage refinance calculator to determine the breakeven point which is the number of months it takes for the savings to outweigh the cost of refinancing. Includes current VA loan rates for 15- and 30-year home purchase and refinance loans.

The refinance calculator can help plan the refinancing of a loan given various situations and also allows the side-by-side comparison of the existing or refinanced loan. While both loan types have similar interest rate profiles the 15-year loan typically offers a lower rate to the 30-year loan. Mortgage loan calculator.

The limit for single family homes in 2022 is 647200. Choose the term usually 30 years but maybe 20 15 or 10 and our calculator adjusts the repayment schedule. Estimate your taxes and insurance so that these amounts will be included in the payment calculation.

Conforming loans have a price limit set annually with high-cost areas capped at 150 of the base cap. Bankrates refinance calculator is an easy-to-use tool that helps estimate how much you could save by refinancing. 51 ARM IO 30 year jumbo.

15 year fixed refi. As a result the data exclude property taxes paid by businesses renters and others. Most homebuyers choose the 30-year fixed loan structure.

An Adjustable-rate mortgage ARM is a mortgage in which your interest rate and monthly payments may change periodically during the life of the loan based. Our calculator includes amoritization tables bi-weekly savings. See todays VA mortgage rates.

Rates Requirements for 2022 April 14 2022 The Best Mortgage Refinance Companies for 2022 June 9 2022. The second set was briefly incorporated into the Bureaus rate spread calculator. Todays national 15-year refinance rate trends.

However for those who can afford the slightly higher payment associated with a 15-year mortgage are getting a better deal in almost every possible way. Find your VA mortgage rate today. From the loan type select box you can choose between HELOCs and home equity loans of a 5 10 15 20 or 30 year duration.

The average 15-year fixed mortgage refinance rate is 5410 with an APR of 5440. The spreads change over time but the 15-year is typically about a half a percent lower than the 30-year. To help you see current market conditions and find a local lender current Redmond mortgage refinance rates are published in a table below the calculator.

Check out the webs best free mortgage calculator to save money on your home loan today. Todays national mortgage rate trends. Then as the COVID-19 crisis struck interest rates crashed to the floor shifting homeowner.

The average APR on a 15-year fixed-rate mortgage rose 8 basis points to 5217 and the average APR for a 5-year adjustable-rate mortgage. The figures in this table are mean effective property tax rates on owner-occupied housing total real taxes paidtotal home value. We offer a calculator which makes it easy to compare fixed vs ARM loans side-by-side.

It takes longer to gain equity. The big advantage of a 30-year home loan over a 15-year loan is a lower monthly payment. 15-year fixed typically have lower interest rates than those with longer terms ie.

Two sets of APORs were published for the week of 7112022 for fixed rate loans with terms of 9 to 12 years and adjustable rate loans with terms of 9 to 50 years. Here are some of the advantages of a 15-year mortgage over a 30-year mortgage. Pros of a 30-year refi.

10 Loan Calculator Templates In Pdf Doc Free Premium Templates

With The Act Database Customized For Insurance Professionals Store Basic Contact Details And Personal Informatio Commercial Insurance Acting

Mortgage Payment Calculator Refinance Calculator Closing Costs Calculator More

How To Do A Cash Out Mortgage Refinance Listerhill Credit Union

Va Funding Fee How Much You Ll Pay Quicken Loans

When You Should Refinance Your Mortgage Listerhill Credit Union

The 15 Best Pizza Cities 2022 Data

50 Mortgage Marketing Ideas To Generate Leads Kaleidico

Pin On Healthy Mind Body Soul

What Is Seller Financing Quicken Loans

Student Loan Refinancing Calculator Dollargeek

Payroll Calculator Templates 15 Free Docs Xlsx Pdf Payroll Template Payroll Simple Business Plan Template

When To Refinance Your Home Buckhead Home Loans

Refinancing Definition Example Investinganswers

The Cost To Refinance A Mortgage Rocket Mortgage

/adjustable_rate_mortgage_what_happens_when_interest_rates_go_up-5bfc386b46e0fb00511d43c5.jpg)

Adjustable Rate Mortgage What Happens When Interest Rates Go Up

Loan Calculator Templates 7 Free Docs Xlsx Pdf Loan Calculator Car Loan Calculator Amortization Schedule